Swift BIC Code For Santander Unraveled

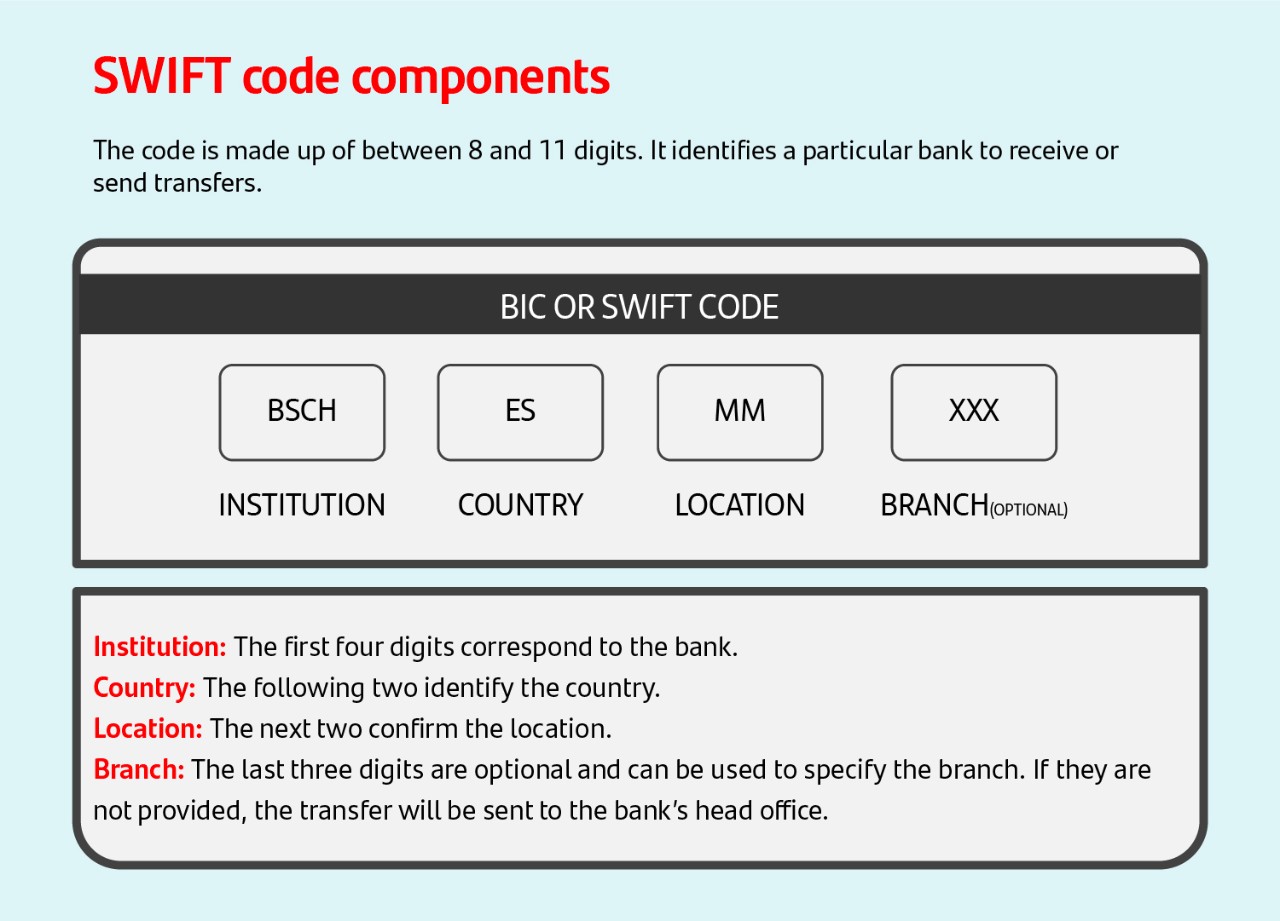

A SWIFT BIC (Bank Identifier Code) is a unique code used to identify financial institutions worldwide. It facilitates secure and efficient international money transfers by providing a standardized way to identify the sender and receiver banks. The SWIFT BIC code for Santander, one of the world's largest banks, is typically a combination of 8 or 11 characters, with the first four characters representing the bank code, the next two characters representing the country code, and the following two or three characters representing the location code.

SWIFT BIC codes play a crucial role in international money transfers. They ensure that funds are sent to the intended recipient and help prevent errors or delays in processing payments. The accuracy of these codes is paramount, as any mistakes can result in lost or delayed funds.

Overall, the SWIFT BIC code for Santander, along with SWIFT BIC codes in general, serve as essential tools in the global financial system. They facilitate cross-border payments, support international trade and commerce, and contribute to the smooth and secure flow of money around the world.

Swift Bic Code For Santander

The SWIFT BIC code for Santander is a unique identifier used for international money transfers. It plays a crucial role in ensuring the secure and efficient processing of cross-border payments.

- Identification: The BIC code uniquely identifies Santander among financial institutions worldwide.

- Standardization: It follows a standardized format, facilitating easy recognition and processing of international payments.

- Security: The BIC code helps prevent errors and fraud by ensuring funds are sent to the intended recipient.

- Global reach: Santander's SWIFT BIC code enables it to connect with banks worldwide, facilitating international transactions.

- Efficiency: BIC codes streamline the process of international money transfers, reducing delays and costs.

- International trade: They support global trade by providing a secure and reliable way to send and receive payments across borders.

- Compliance: Using the correct BIC code ensures compliance with international banking regulations.

- Accuracy: Accurate BIC codes are essential to avoid delays or errors in processing international payments.

Overall, the SWIFT BIC code for Santander is a vital tool for international money transfers, promoting secure, efficient, and compliant cross-border payments.

Identification

The SWIFT BIC code is crucial for identifying Santander in international money transfers. Without a unique identifier, it would be challenging to ensure that funds are sent to the correct financial institution, especially when dealing with cross-border transactions involving multiple banks.

The BIC code serves as a unique fingerprint for Santander, allowing other financial institutions to easily recognize and process incoming and outgoing payments. This plays a vital role in ensuring the accuracy and efficiency of international money transfers.

For example, when a customer initiates an international money transfer to a Santander account, the sender's bank will use the BIC code to identify Santander as the recipient institution. This ensures that the funds are routed to the correct bank, preventing delays or errors that could occur with incorrect or missing BIC codes.

Overall, the unique identification provided by the BIC code is a fundamental component of the SWIFT system, facilitating secure and efficient cross-border payments.

Standardization

The standardization of the SWIFT BIC code format is crucial for the efficient and seamless processing of international payments involving Santander. The standardized format ensures that all BIC codes adhere to a consistent structure and length, allowing for easy recognition and processing by financial institutions worldwide.

The SWIFT BIC code for Santander, like all other BIC codes, comprises a combination of 8 or 11 characters. The first four characters represent the bank code, the next two characters represent the country code, and the following two or three characters represent the location code. This standardized format facilitates the quick and accurate identification of Santander in international money transfers.

For example, when a payment is initiated to a Santander account in Spain, the BIC code will include "ES" as the country code, ensuring that the funds are routed to the correct country. Similarly, the location code helps identify the specific branch or office of Santander within Spain, ensuring that the funds are delivered to the intended recipient.

Overall, the standardization of the SWIFT BIC code format plays a vital role in the smooth functioning of international payments involving Santander. It enables efficient processing, reduces errors, and ensures that funds are delivered securely and swiftly.

Security

The security aspect of the SWIFT BIC code is paramount in the context of "Swift Bic Code For Santander," as it plays a crucial role in preventing errors and fraud in international money transfers. Here are several key facets:

- Accurate Identification: The BIC code precisely identifies Santander among numerous financial institutions worldwide. This accurate identification reduces the risk of funds being misrouted or falling into the wrong hands.

- Prevention of Fraudulent Transactions: The BIC code helps prevent fraudulent transactions by ensuring that funds are only sent to authorized accounts. It acts as a security measure to safeguard against unauthorized access to funds.

- Compliance with Regulations: Using the correct BIC code ensures compliance with international banking regulations, which are in place to combat money laundering and other financial crimes. Adherence to these regulations enhances the security of international money transfers.

- Reduced Errors: The standardized format of the BIC code minimizes the likelihood of errors in data entry or processing. This reduces the risk of funds being sent to incorrect accounts due to human error or technical glitches.

Overall, the security features embedded in the BIC code play a vital role in safeguarding international money transfers involving Santander. By preventing errors and fraud, the BIC code contributes to the secure and reliable movement of funds across borders.

Global reach

The SWIFT BIC code for Santander serves as a gateway to a global network of banks and financial institutions, facilitating seamless international transactions. Here are key facets that highlight this global reach:

- Interbank connectivity: The BIC code enables Santander to connect with other banks worldwide, regardless of their geographical location. This connectivity forms the backbone of international money transfers, allowing funds to flow across borders efficiently.

- Cross-border payments: The BIC code plays a crucial role in cross-border payments. It facilitates the exchange of currencies and ensures that funds are routed to the correct destination, even if it involves multiple intermediary banks.

- International trade: The SWIFT BIC code supports global trade by enabling secure and efficient payments between businesses and individuals across different countries. It removes geographical barriers, making it easier to conduct international business transactions.

- Foreign currency transactions: The BIC code enables Santander to offer foreign currency exchange services to its customers. Individuals and businesses can use the BIC code to convert their funds into different currencies, facilitating international payments and investments.

In conclusion, Santander's SWIFT BIC code is a key component of its global reach, enabling seamless international transactions, cross-border payments, foreign currency exchange, and support for international trade. It connects Santander to a vast network of financial institutions, facilitating the movement of funds worldwide.

Efficiency

The SWIFT BIC code for Santander plays a vital role in enhancing the efficiency of international money transfers, contributing to faster and more cost-effective transactions.

- Automation and Standardization: BIC codes automate the process of international money transfers, eliminating the need for manual intervention and reducing the risk of errors. The standardized format ensures seamless processing, avoiding delays caused by incompatible or incorrect data.

- Reduced Intermediary Banks: BIC codes facilitate direct transfers between banks, reducing the number of intermediary banks involved in the process. This reduces transaction fees and shortens the overall processing time, resulting in faster delivery of funds.

- Real-Time Processing: BIC codes enable real-time processing of international money transfers, allowing funds to be credited to the recipient's account almost instantaneously. This eliminates delays associated with traditional methods and provides greater convenience to customers.

- Cost Savings: By streamlining the process and reducing the number of intermediary banks, BIC codes contribute to cost savings for international money transfers. Lower transaction fees and faster processing times translate into reduced costs for businesses and individuals.

In summary, the SWIFT BIC code for Santander enhances efficiency in international money transfers through automation, standardization, reduced intermediary banks, real-time processing, and cost savings. These factors collectively contribute to faster, more secure, and more cost-effective cross-border transactions.

International trade

The SWIFT BIC code for Santander plays a pivotal role in supporting international trade by facilitating secure and reliable cross-border payments. Here's how these two elements are interconnected:

- Secure and efficient transactions: The BIC code ensures secure and efficient international money transfers, enabling businesses to engage in global with confidence. It reduces the risks associated with cross-border payments, such as fraud and delays.

- Reduced costs and faster processing: The BIC code streamlines the process of international money transfers, reducing transaction costs and processing times. This makes it more cost-effective and convenient for businesses to conduct international trade.

- Facilitation of global supply chains: The BIC code enables seamless payments between businesses across different countries, facilitating the movement of goods and services. It supports complex global supply chains, allowing businesses to source materials and products from around the world.

- Expansion of market reach: The BIC code allows businesses to expand their market reach by enabling them to sell and purchase goods and services globally. It removes geographical barriers and makes it easier for businesses to compete in the international marketplace.

In conclusion, the SWIFT BIC code for Santander is an essential component of international trade. It provides a secure, reliable, and efficient way to send and receive payments across borders, fostering global trade and economic growth.

Compliance

The SWIFT BIC code for Santander plays a crucial role in ensuring compliance with international banking regulations, which are in place to combat money laundering, terrorist financing, and other financial crimes. Here are some key facets that highlight the connection between compliance and the BIC code:

- Legal and regulatory requirements: Financial institutions are legally obligated to comply with international banking regulations, which include requirements for accurate and timely identification of parties involved in financial transactions. The BIC code serves as a unique identifier for Santander, enabling banks to meet these regulatory requirements.

- Prevention of financial crimes: The BIC code helps prevent financial crimes by ensuring that funds are only sent to authorized accounts. It reduces the risk of money laundering and terrorist financing by providing a secure and traceable method for identifying the origin and destination of funds.

- Transparency and accountability: The BIC code promotes transparency and accountability in international money transfers. It creates an auditable trail that allows regulators and law enforcement agencies to track financial transactions and identify any suspicious activities.

- Reputation and trust: Adhering to international banking regulations and using the correct BIC code helps Santander maintain a positive reputation and build trust with its customers, regulators, and other financial institutions.

In conclusion, the SWIFT BIC code for Santander is an essential element in ensuring compliance with international banking regulations. It contributes to the prevention of financial crimes, promotes transparency and accountability, and safeguards the reputation and trust of Santander in the global financial system.

Accuracy

The accuracy of SWIFT BIC codes, including the one for Santander, is of paramount importance in ensuring the smooth and error-free processing of international payments. BIC codes serve as unique identifiers for financial institutions, and any inaccuracies or errors in their usage can lead to significant delays and complications in the transfer of funds across borders.

When an international payment is initiated, the sender's bank relies on the BIC code to identify the recipient bank accurately. An incorrect or mistyped BIC code can result in the funds being routed to the wrong institution, causing delays and potential loss of funds. Accurate BIC codes are essential to ensure that international payments are processed swiftly and reach the intended recipient without any hindrances.

For instance, if a payment is intended for a Santander account in Spain but an incorrect BIC code is used, the funds may be mistakenly sent to a different branch or even a different bank altogether. This can lead to protracted delays in locating and recovering the funds, causing inconvenience and financial loss to the sender and the intended recipient.

Therefore, it is crucial for banks and financial institutions to exercise due diligence in verifying and utilizing the correct BIC codes when processing international payments. Accurate BIC codes not only ensure timely and error-free transactions but also contribute to the overall efficiency and reliability of the global financial system.

FAQs on "Swift Bic Code For Santander"

This section provides answers to frequently asked questions regarding the SWIFT BIC code for Santander, ensuring a comprehensive understanding of its usage and significance in international money transfers.

Question 1: What is the SWIFT BIC code for Santander?The SWIFT BIC code for Santander varies depending on the country and branch of the bank. It is typically an 8 or 11 character code that uniquely identifies the specific Santander branch involved in an international money transfer.Question 2: Where can I find the SWIFT BIC code for Santander?

The SWIFT BIC code for Santander can be obtained from the bank's website, mobile banking app, or by contacting the bank directly. It is essential to ensure the accuracy of the code to avoid delays or errors in international payments.Question 3: Why is it important to use the correct SWIFT BIC code?

Using the correct SWIFT BIC code is crucial to ensure that international payments are routed to the intended Santander branch and credited to the correct account. An incorrect BIC code can result in delays, additional fees, or even loss of funds.Question 4: What are the consequences of using an incorrect SWIFT BIC code?

Using an incorrect SWIFT BIC code can lead to several issues, including:

- Delayed or failed payments

- Additional fees or charges

- Misdirected funds

- Potential loss of funds

To verify the accuracy of a SWIFT BIC code, you can use online SWIFT BIC code validation tools or contact the bank directly. Ensuring the correctness of the code is crucial for smooth and secure international money transfers.Question 6: Is the SWIFT BIC code the same for all Santander branches?

No, the SWIFT BIC code is not the same for all Santander branches. Each branch has a unique code that identifies its specific location and facilitates direct transfers to the intended account.

Tips on Using "Swift Bic Code For Santander"

When making international money transfers to a Santander account, using the correct SWIFT BIC code is essential to ensure the funds reach the intended recipient swiftly and securely. Here are some tips to keep in mind:

Tip 1: Obtain the Correct BIC CodeVerify the SWIFT BIC code directly with Santander's website, mobile banking app, or by contacting the bank. Ensure the code matches the specific branch and country of the recipient's account.

Tip 2: Double-Check the CodeBefore initiating the transfer, carefully review the BIC code to avoid errors. A single incorrect character can result in delays or misdirected funds.

Tip 3: Use Online Validation ToolsUtilize online SWIFT BIC code validation tools to confirm the accuracy of the code. These tools can help identify any potential errors or inconsistencies.

Tip 4: Contact the RecipientIf possible, ask the recipient to provide their bank statement or account details, which typically include the correct SWIFT BIC code for their Santander account.

Tip 5: Allow Ample Time for TransferInternational money transfers can take time to process, especially if there are any discrepancies in the BIC code or other payment details. Allow sufficient time for the funds to reach the recipient's account.

Tip 6: Confirm the Transfer DetailsOnce the transfer is initiated, retain a record of the transaction, including the BIC code, amount, and transfer date. This information will be helpful for tracking the transfer or resolving any potential issues.

Tip 7: Seek Assistance if NeededIf you encounter any difficulties in obtaining or verifying the SWIFT BIC code, do not hesitate to contact your bank or Santander's customer support for assistance.

Tip 8: Be Vigilant Against FraudBe cautious of unsolicited emails or communications requesting you to provide or change the SWIFT BIC code for a Santander account. Fraudulent attempts may involve providing incorrect BIC codes to redirect funds to unauthorized accounts.

By following these tips, you can increase the accuracy and efficiency of your international money transfers to Santander accounts, ensuring that your funds reach the intended recipient safely and on time.Conclusion

The SWIFT BIC code for Santander is a crucial element in facilitating secure and efficient international money transfers. Its unique identification, standardized format, and global reach enable seamless cross-border transactions, supporting international trade and commerce. The accuracy of BIC codes is paramount to avoid delays or errors in processing payments, ensuring funds reach the intended recipients swiftly and securely.

By utilizing the correct SWIFT BIC code, individuals and businesses can confidently engage in global financial transactions, knowing that their funds are protected and will arrive at their desired destination. The continued evolution and adoption of BIC codes contribute to the efficiency and reliability of the international financial system, fostering economic growth and global connectivity.

Unlocking The Secrets Of The Circle: Dive Into The Diameter

Unveiling The Hidden Truths Behind "How Many Kids Does Sue Have": A Journey Of Discovery

Unveiling The Enigma Of David Bellisario: Insights From Wikipedia

SWIFT/BIC del Banco Santander ¿Cuál es?

Código BIC SWIFT Santander 2022 EducaBanco

What is the SWIFT code?

ncG1vNJzZmimlZmur7%2FEZ5imq2NjsaqzyK2YpaeTmq6vv8%2Bamp6rXpi8rnvSsKCfrF2XtqR5wqibnmWWpL9uv8Cnq5qmlJq%2Fb7TTpqM%3D